The Manila skyline

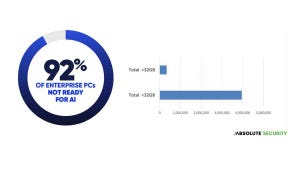

Cyberattacks & Data Breaches

Philippines Pummeled by Assortment of Cyberattacks & Misinformation Tied to ChinaPhilippines Pummeled by Mix of Cyberattacks & Misinfo Tied to China

The volume of malicious cyber activity against the Philippines quadrupled in the first quarter of 2024 compared to the same period in 2023.

Keep up with the latest cybersecurity threats, newly discovered vulnerabilities, data breach information, and emerging trends. Delivered daily or weekly right to your email inbox.

.jpg?width=100&auto=webp&quality=80&disable=upscale)