If data security were a student, its report card would read "Not performing to potential." Here's why.

There are a number of sleepy corners of the security industry, but none perhaps as perplexing as the market for data protection. Why? Given recent metrics and clear trends, data protection should be a massive security segment:

● The volume of data created has exploded, as well as the volume of people handling it. So, too, have the repositories it resides upon — often more than one cloud service provider, and all are changing faster than the answer to the pandemic era question, "Where can I safely get a haircut?"

● Data is increasingly shared across partners. When you combine this with the trends above, the foundational question of "where's my data?" becomes extremely hard to answer.

● A global tangle of data privacy regulations (GDPR, CCPA, LGPD, etc.) impose increasingly stiff penalties for breaches and leaks with complexity increasing weekly.

● In spite of all of this, data breaches are so frequent — 540 reported through June 2020, according to the Identity Theft Resource Center — that the most common reaction today is an apathetic shrug of the shoulders.

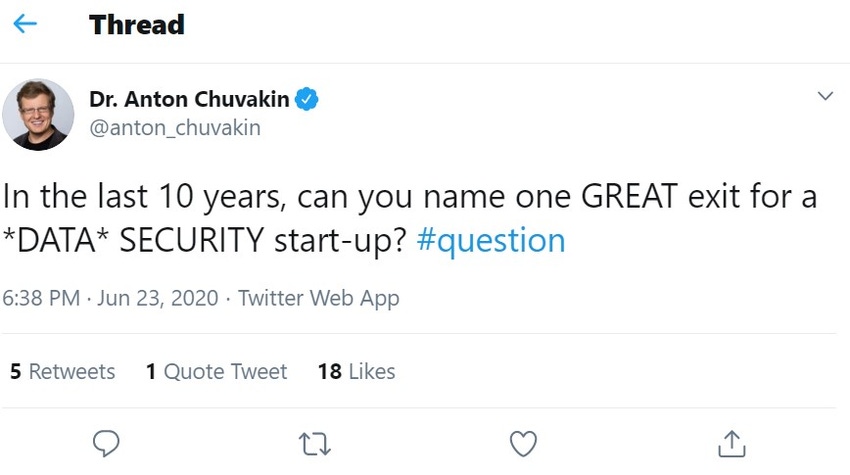

"Great exits" for startups provide great returns for investors, values at high multiples of revenues, resulting in an IPO or acquisition at hundreds of millions, and sometimes more. There are tailwinds aplenty to carry the data protection market to an impressive size and drive at least a handful of great exits, an issue raised by Dr. Anton Chuvakin in a Twitter threat earlier this summer.

It can certainly be argued that since there are compelling alternative data protection solutions at the network, endpoint, or the application layers to prevent breaches, bringing protection to the data itself seems too obvious an answer to ignore. After all, every data breach has exactly one thing in common: the data itself. Yet despite this seemingly compelling logic, Gartner forecasts the data security market at $2.85 billion for 2020 and 7.5% compound annual growth rate. This is smaller than every other security segment except the fledgling cloud security market, which is growing at 33%, and the hodgepodge category of "other." If the data security category were a student, it's report card would read "Not performing to potential."

Like breaches, great exits have considerable variety but nearly all have one thing in common: successful customers. Stellar acquisitions and IPOs require that customers not only purchase a product but renew and expand their purchases over time. But they don't do this if they aren't successful with the product. History validates this with few exceptions.

So, how about we reframe the question: "Where are all the successful data security customers?" This is where the answers become sincerely interesting, and a little uncomfortable. Often the "data security" category is nearly synonymous with data loss prevention (DLP) products, which command the largest dollar spend. Encryption, tokenization, and related data protection offerings abound, but they are less frequently the main focus of a company compared with DLP. So, while imperfect, an exploration of why DLP customers aren't more successful provides a reasonable answer to the original question about great exits because DLP pitfalls have been well documented:

● Long time to value. Classic DLP deployments take months rather than days to reach steady state, weeks at best, assuming that you have engaged services to assist with the effort.

● Constant tuning. In a security market where the headliners have historically been "fit it and forget it" all-stars such as firewalls and antivirus software, DLP has stood in stark contrast from day one. It requires an initial, significant investment to create a baseline policy, and regular care and feeding thereafter, greatly exceeding the expectations of all but the most patient customers.

● False positives. DLP alerts are famously opaque. Should you block or allow user jsmith from sending a spreadsheet that includes Social Security numbers to mjacobs? A severe lack of context has prevented DLP from being truly useful. Too much noise, not enough signal.

● Overemphasized regulated data types. Compliance has been one of the most important drivers for data security, and as a result, regulations have played a heavy hand in dictating the focus of the solutions. Regulations, however, skew emphasis toward customer data and underserve customers that are more concerned about intellectual property.

Are these problems intractable? Absolutely not. To address them, I suggest the following:

● Refocus on making data protection products easier to deploy and integrate. Start with an open design that assumes integration is a top priority. Follow that with a challenge to make it entirely self-service. Even if you fall short of your goal, you nevertheless will end up in a better place with faster time to value.

● Equally increase investment in user experience. What if we assumed that the user is not a data security professional or a consultant, but someone who is new to data protection, is short on time, and wants handrails to guide their usage?

● Add a generous helping of context to boost alert quality. How about connecting HR systems so we understand more about the people involved? How about effective, automated data classification so we know more about the data itself? Delivering high-quality, precise alerts is hard, but it's well worth the investment.

● Think beyond the acronyms for all those regulations. Strive for an equal consideration for a company's crown jewel data as well as regulated data types. Data lakes and other repositories at scale now demand attention well beyond what they've received historically.

Where have we seen such a transformation before? Look no further than the endpoint security market, which recently went through a renaissance after having been neglected by the previous market leaders. It was fresh thinking, customer empathy, and a considerable investment of time and resources that fundamentally reshaped endpoint security and sent it into a new growth trajectory that is obvious today.

So, when will we see great exits for data security companies? The answer to this question has nothing to do with the size of the problem. It has everything to do with happy customers.

About the Author(s)

You May Also Like

Beyond Spam Filters and Firewalls: Preventing Business Email Compromises in the Modern Enterprise

April 30, 2024Key Findings from the State of AppSec Report 2024

May 7, 2024Is AI Identifying Threats to Your Network?

May 14, 2024Where and Why Threat Intelligence Makes Sense for Your Enterprise Security Strategy

May 15, 2024Safeguarding Political Campaigns: Defending Against Mass Phishing Attacks

May 16, 2024

Black Hat USA - August 3-8 - Learn More

August 3, 2024Cybersecurity's Hottest New Technologies: What You Need To Know

March 21, 2024