Enterprise cybersecurity technology research that connects the dots.

With more staff working remotely, identity, authentication, and access (IAA) has never been more important. Market forecasts, drivers, and trends are explored.

The identity, authentication, and access (IAA) market is set to grow by 13.4% in revenue in 2021, reaching $28.9 billion, according to Omdia's latest Identity Authentication Access Market Tracker. During 2021, the increasing number of security breaches and attacks has brought into even sharper focus the need for strong IAA technology. Identity has never been more important for cybersecurity than now. In this sense, COVID-19 merely turbocharged a tendency that had been underway for several years, i.e., identity adopting a central role in this market and being invoked in all the other areas, including infrastructure and data security.

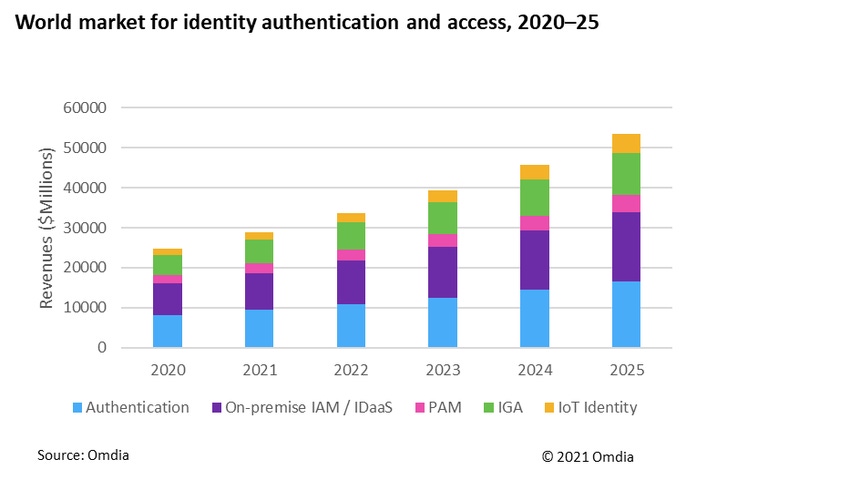

In 2021, authentication continues to be the largest segment of the IAA market, representing $9.4 billion (or 32.6% of the total). In 2025, authentication revenue is projected to reach $16.6 billion (with a CAGR of 15.1%). In 2021, the combined field of on-premises IAM and cloud-based identity-as-a-service (IDaaS) is projected to be the second largest segment, with revenue of $9.3 billion. Omdia believes that this segment is driven by increased demand for cloud-based solutions such as IDaaS. Meanwhile, identity governance and administration (IGA) and privileged access management (PAM) are projected to account for $5.8 billion and $2.4 billion, respectively, in 2021. Internet of Things (IoT) identity was the smallest segment in 2021, with revenue of $1.9 billion (or 6.6% of the total). However, the IoT identity segment is projected to have the highest growth during the forecast period, increasing to $4.7 billion by 2025 (with a CAGR of 24.3%).

2021: The Year of Mergers, Acquisitions, and New Entrants

The following section highlights some of the major announcements in the IAA space in 2021:

In March 2021, Okta announced it was spending $6.5 billion, entirely in stock, to purchase Auth0.

In March 2021, TPG Capital acquired PAM vendor Thycotic for $1.4 billion. It plans to merge it with Centrify, the other PAM vendor it acquired in January this year. Centrify will thereby hope to present a serious challenge to PAM market leader CyberArk.

In April 2021, Okta, a leading player in IDaaS, announced its entry into two other segments of the identity market: PAM and IGA.

In June 2021, it was announced that Transmit Security raised $543 million Series A funding with the mission to rid the world of passwords.

In July 2021, Microsoft acquired CloudKnox Security, which is the market leader in cloud permissions management (CPM) technology.

In October 2021, One Identity, which offers PAM, IGA, and Active Directory management and security (ADMS) products, acquired OneLogin, a player in the growing IDaaS market.

As can be seen from this section, 2021 has seen a reasonable amount of market activity in the form of mergers, acquisitions, and vendors entering new segments of the markets. Omdia believes this trend will continue in 2022, as vendors fight for increased market share in this growing market.

Conclusions

In summary, the IAA market has a bright future due to increased demand as a result of remote working, an increase in mergers and acquisitions activity, and large players entering new segments of the market. Growth has been driven by the pandemic, in that the sharp increase in fraud attacks and security breaches has driven demand for products and solutions in this segment of cybersecurity. The IAA sector is projected to show good growth during the next five years, reaching $53.4 billion in 2025 (with a CAGR of 16.7%).

About the Author(s)

You May Also Like

The fuel in the new AI race: Data

April 23, 2024Securing Code in the Age of AI

April 24, 2024Beyond Spam Filters and Firewalls: Preventing Business Email Compromises in the Modern Enterprise

April 30, 2024Key Findings from the State of AppSec Report 2024

May 7, 2024Is AI Identifying Threats to Your Network?

May 14, 2024

Black Hat USA - August 3-8 - Learn More

August 3, 2024Cybersecurity's Hottest New Technologies: What You Need To Know

March 21, 2024